Resale Continues to Rise: Global Secondhand Sales to Hit $350B by 2027

Consumers and retailers are turning to resale more than ever amid economic uncertainty, according to ThredUp’s 11th annual Resale Report, conducted by GlobalData.

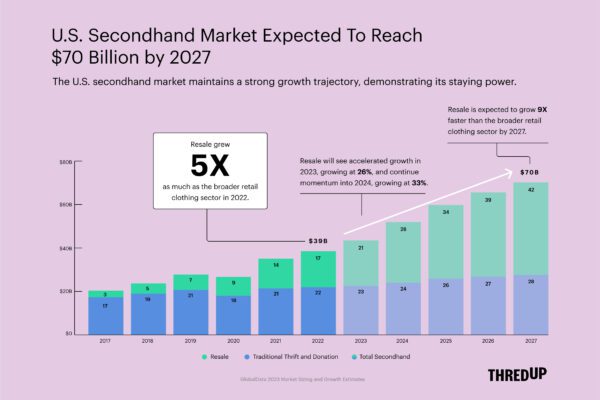

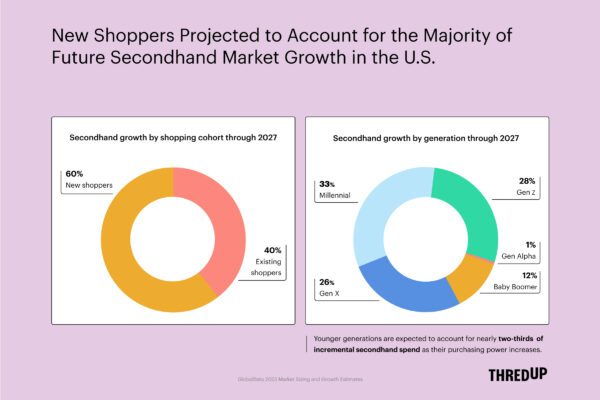

The study found that more than half of U.S. consumers (52%) shopped secondhand apparel in 2022. In fact, one in three apparel items bought in the last 12 months in the U.S. was secondhand, and among Gen Z that number was two in five. As a result, the U.S. secondhand apparel market is projected to reach $70 billion by 2027; globally the secondhand market is set to nearly double by 2027, reaching $350 billion.

“Resale isn’t constrained by geography, and it’s not a flash in the pan — it is now a global mainstay of consumer behavior,” said Anthony Marino, President of ThredUp in an interview with Retail TouchPoints. “In the U.S. the online resale market is the fastest growing, with 21% growth [expected annually] over the next five years. The reason I call that out is because, what the online resale market does for the consumer is make everything easier. Searching, filtering, personalization — all the greatest superpowers of online shopping that have historically been missing from offline thrift are driving the market forward and making it easier for people to think secondhand first.”

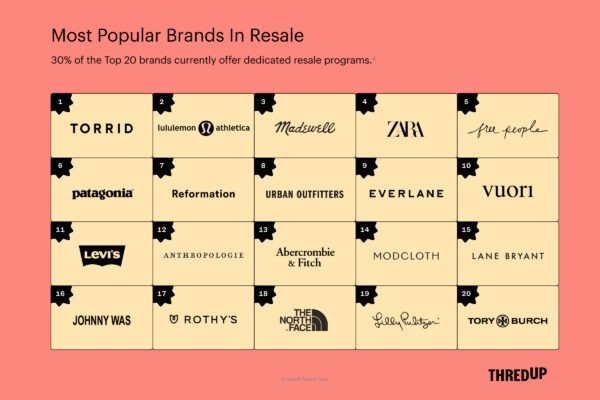

Retailers are paying attention to the trend, with branded resale programs skyrocketing in 2022 as 88 new brands launched their own offerings, a 244% increase from 2021. Among the new entrants in 2022 were Francesca’s, Torrid, Nobis, Amazon, Zara, Shein, Hot Topic, On, Marimekko, Saks Off 5th and many more. In fact, 58% of retail executives surveyed now say that a resale offering is table stakes, up six percentage points from 2021. Not only that, but one-third of retailers said if resale proved to be successful, they would cut their production of new products. In 2022, U.S. consumers bought 1.4 billion secondhand apparel items in 2022 that they normally would have bought new, up 40% from 2021.

“Retailers and brands that are in the business of selling new things are embracing resale more than ever, and the reason why they’re doing that is because 86% of those executives say, ‘Our customers are already [shopping resale],’” said Marino. “As an executive at a big retailer or brand I have a choice — I can act like resale has nothing to do with my customer or I can develop a resale strategy. Among Gen Z shoppers, 64% say they look to buy used before new. So if you’re running a business and you want young customers who have 20, 30, 40 years of lifetime value ahead of them, you better give them used choices today so that they decide to spend that money with you and not somebody else.”

Along with satisfying customer demand and supporting ESG goals, retailers also expect their resale programs to have a positive impact on the bottom line, with 82% saying they expect it to generate positive ROI. In fact, financial considerations are driving resale uptake not just among retailers and brands but consumers as well: last year, 37% of consumers spent a higher portion of their apparel budget on secondhand, and of those, 63% increased their spend in response to inflation. Additionally, value is the top motivator for secondhand shoppers, followed by quality, selection, convenience and transparency.

“This isn’t new — crises tend to put retail in a very cheerful spotlight, whether it was the early days of COVID, inflation or recession,” said Marino. “When the consumer is under pressure, they look for a smart alternative, and they’re increasingly finding secondhand.”

While the environmental impact may not be a top motivator of resale purchasing behavior among the broader consumer set, among Gen Z it is, with sustainability ranking as a top 5 motivator for that generation and 47% saying they refuse to buy from non-sustainable apparel brands and retailers (up 11 percentage points from 2021).

“The consumer is making the connection in their mind that there’s a smarter, more sustainable way to consume, it’s better for the environment and better for their wallet,” said Marino, who added that regulatory support will be key to driving home these efforts among both consumers and businesses by creating further pro-resale incentives.

For its part, ThredUp continues to roll out initiatives to help consumers break their fast fashion addiction and understand the positive impact of turning to resale. The latest of these is the Fashion Footprint Calculator, an interactive tool designed to empower and educate consumers on the environmental impact of their fashion habits.

“When we talk to and survey young shoppers they often say the same thing to us: ‘I am addicted to fast fashion, can you please get me off the drug? I know it’s bad for the environment, I know the product doesn’t have a long life, but it’s so cheap and it arrives so quickly, I can’t help myself,” said Marino. “So we said let’s make it super easy for these young shoppers to determine whether they are making healthy choices or unhealthy choices in their purchasing habits.

“Our philosophy is to educate the consumer as much as we can because clearly, they’re listening,” added Marino. “These issues around fashion waste and the climate in general are more front and center now than ever in the regulatory world, in the consumer’s world, and we believe that increasingly they’re going to become front and center in the minds of brands and retailers.”