Mastering the Pricing Override Challenge: Strategies for Increased Profitability

By David Bauders, SPARXiQ CEO

In many wholesale distribution verticals, average EBITDA as a percentage of sales is only four percent. In contrast, elite distributors in the same markets are earning double or triple this average each year. They can invest in innovation, automation, talent selection and development — further expanding their customer value-add, efficiency, and competitive differentiation. They can acquire and arbitrage lower-performing distributors.

For four-percent EBITDA companies, 96 cents of every dollar is going to vendors, sales teams, inventory carrying costs, and general and administrative expenses. These costs are relatively visible and susceptible to careful management. There is another hidden cost, however, that suppresses the profitability of the average company. Pricing overrides. This article explores the impact of pricing overrides on profitability and presents four key strategies to tackle this issue effectively, resulting in increased consistency and improved financial performance.

Understanding the Pricing Override Challenge

Pricing overrides are the great bane of profitability. For many distributors 40, 50 or even 70 percent of revenue dollars come from on-the-fly pricing decisions that lack structure, rules or guidelines. Such overrides commonly carry margins of 1000 basis points lower than system pricing, making a substantial impact on a company’s EBITDA. Because there is no budget or financial controls for overrides, the override problem persists unchecked for most companies. Furthermore, the sales team’s outsized influence on the organization produces a stalemate that eventually appears irresoluble.

Key Levers for Tackling the Pricing Override Challenge

To master the override challenge, businesses should employ the following four key levers:

- Get System Pricing Right: Establish system pricing that aligns with the markets sellers operate in. Too often system pricing is too aggressive, too blunt, or too generalized to work in most scenarios. Getting system pricing right is job one of managing pricing methods mix and reducing overrides.

- Train Sellers: Empower sales teams by providing them with professional training in negotiation techniques. 90 percent of professional buyers have been professionally trained in the art of negotiation, while less than 10 percent of sellers have been. Buyers hold a significant advantage in getting favorable pricing deviations. By training sellers to negotiate effectively, businesses can level the playing field.

- Install Guardrails: Implement ERP pricing controls that limit or block pricing overrides for low-sensitivity customer/product combinations. These guardrails can reduce the frequency and magnitude of overrides, ensuring more consistent and controlled pricing.

- Align Incentives: Create incentives that promote adherence to system pricing and penalize overrides for sales teams. Consider adding spiffs and rewards that encourage the use of robust system pricing.

These four levers work best when deployed together as a comprehensive solution. Cherry-picking among them will often create unintended consequences. If we train sellers without implementing a robust pricing system, we will fail them at the point of defining what good looks like at the street level. If we implement guardrails without deploying a robust pricing system, the standards will be unattainable, or not impactful, or both — creating friction without purpose.

The Payoff of Tackling Pricing Overrides

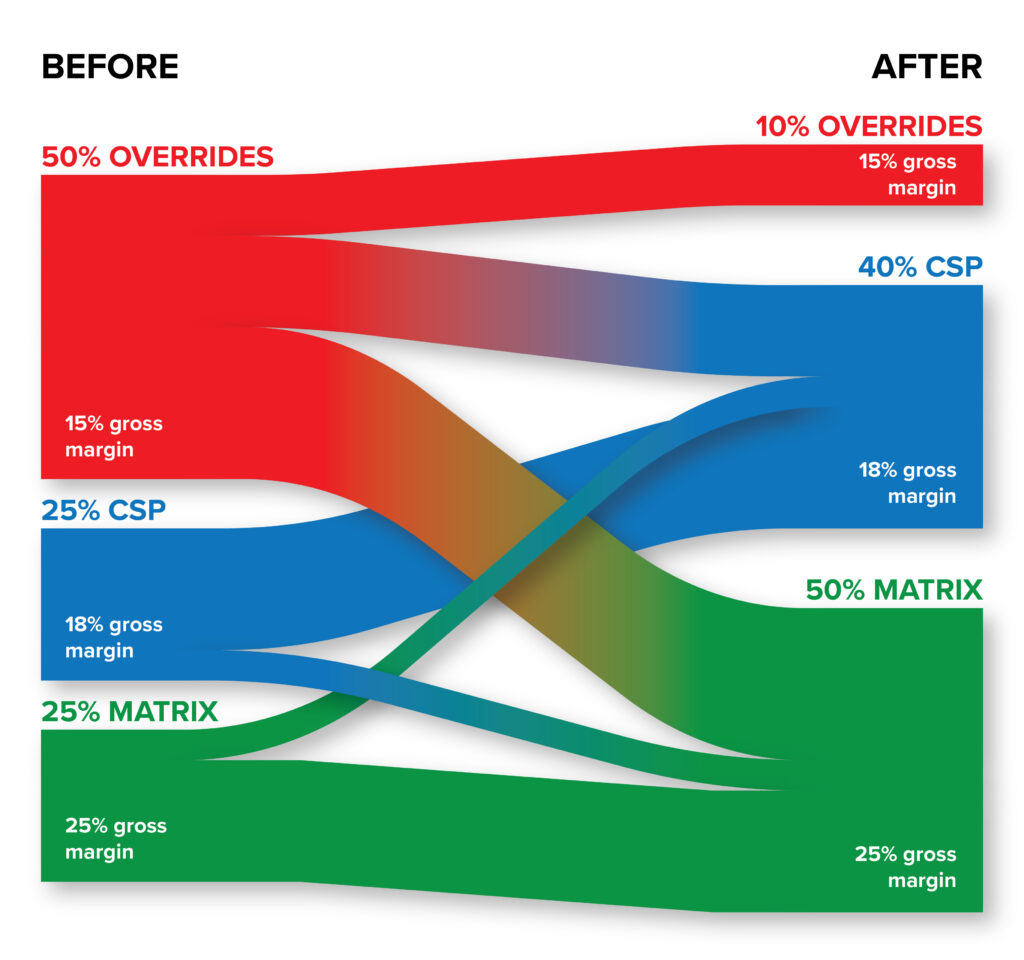

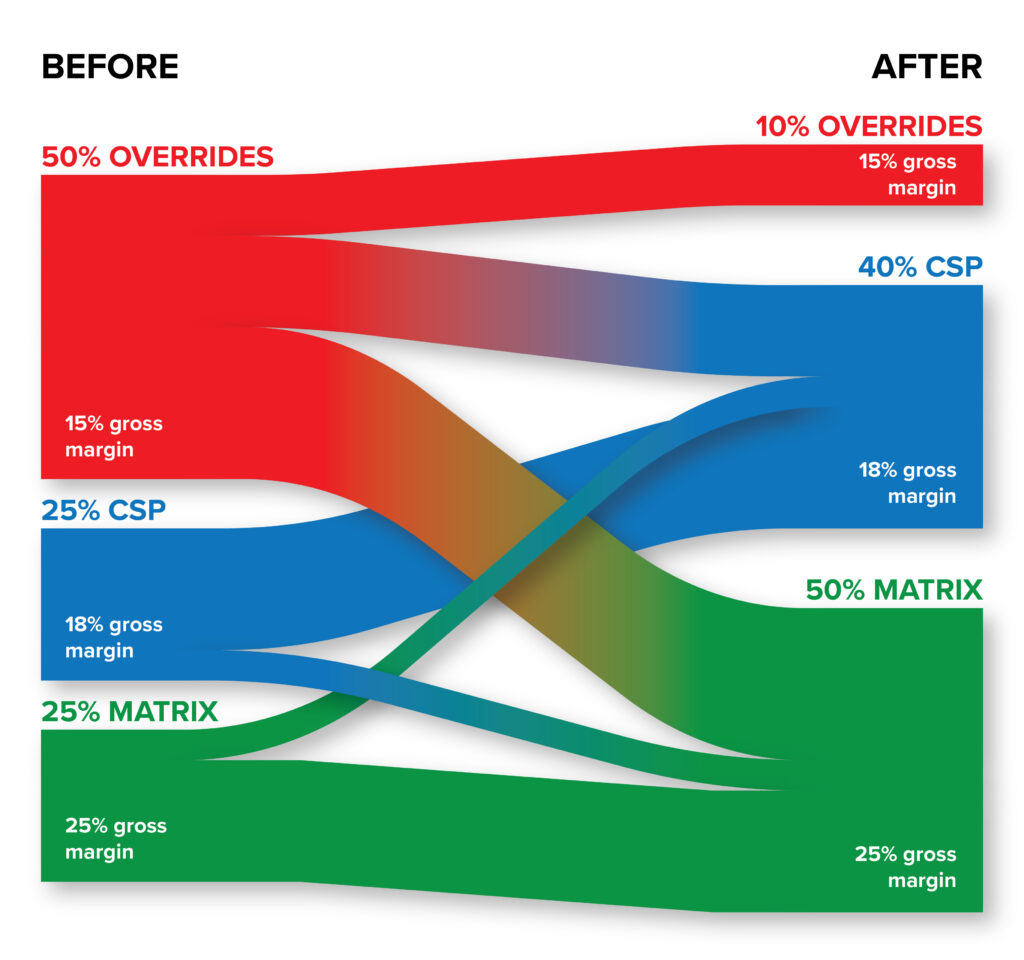

Consider the below before-and-after chart of a distributor that has tackled their pricing overrides. Before doing so, they were pricing half of their revenues on overrides, a quarter on customer specific pricing (CSP) and the other quarter through the matrix. As is typically the case, overrides carry the lowest gross margin, with customer-specific GM slightly higher and matrix pricing producing the highest margin.

In this example, after working to formalize pricing, this distributor can now price 50 percent of revenue through the matrix and 40 percent through CSP, with only 10 percent as manual overrides. To achieve this level of override reduction, they shifted their pricing methods in two important ways:

- Using managed CSP pricing to address the more sensitive sales previously priced via override

- Pushing their low-sensitivity override sales into the matrix

Now their pricing system is managing 90 percent of revenues, vs. the 50 percent baseline. What’s it mean to the bottom line? The average gross margin has now increased to 21.2 percent from 18.25 percent, a gain of 295 basis points. If the EBITDA percentage at the outset was the typical four percent, it’d be increased to 6.95 percent, making the company 74 percent more profitable.

But that’s not the whole story. Because they have shifted revenues from unmanaged, uncontrollable overrides to managed CSPs and Matrices, they can now optimize each of those pricing structures. It’s common to improve matrix pricing by 400 basis points or more and CSP pricing by 200 basis points or more by better managing vendor cost increases, optimizing margins on low-sensitivity SKUs within product families, and controlling discounting.

The total additional gain from optimization — which required migration of override revenue into controlled/structured Matrix and CSP methods — is 280 basis points (using the above numbers proportionately into the new pricing methods mix). With both the rebalancing of price methods and the optimization, the company’s EBITDA% expands to 9.75 percent, a staggering 144 percent gain versus the original baseline of four percent.

Make a Plan to Take Control of Your Overrides

Price overrides are a prevalent, costly problem. Yet, there are companies who have been able to make significant improvements in their pricing system (and processes) to overcome their override challenges. When distributors fix their overrides, they gain consistency in the market, reduce pricing management challenges, and permanently improve their bottom line.

To learn more about these strategies and what actions you can take, download our comprehensive eBook: 4 Key Steps to Reduce Price Overrides.

About the Author

As CEO of SPARXiQ, David Bauders has been committed to helping companies accelerate sales and profitability with the right analytics, tools and complementary skills training since he founded the company in 1993.

The post Mastering the Pricing Override Challenge: Strategies for Increased Profitability appeared first on National Association of Wholesaler-Distributors.