What Sales and Pricing Teams Need From Each Other

David Bauders, CEO SPARXiQ

Sell more or drive higher margins? This is the perennial tradeoff that executives face when setting performance targets. The conventional wisdom says you can sell more at lower margins or sell less at higher margins. This logic sets up the fundamental conflict between sales teams (which seek to maximize sales) and finance (which seeks stronger profitability). Optimization requires finding the best combination of price and volume to maximize profit, often with some level of compromise to both.

I’d like to outline an alternative approach to profit maximization that can successfully navigate hidden market forces to both accelerate new-business capture and raise overall margin performance. An advanced pricing strategy can improve both revenue capture as well as profitability based on a deeper understanding of buyer behaviors and customer lifecycle.

Planned vs. Unplanned Spend

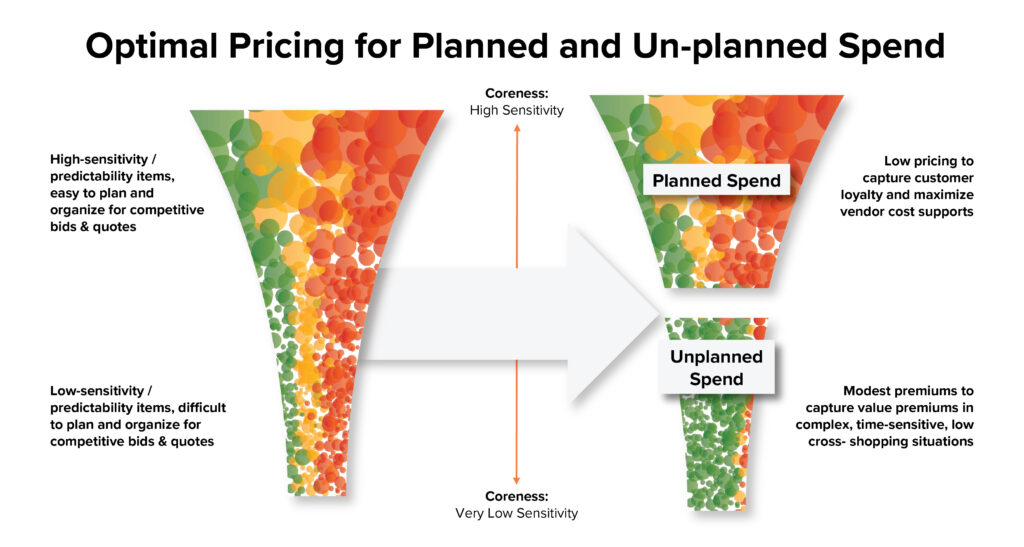

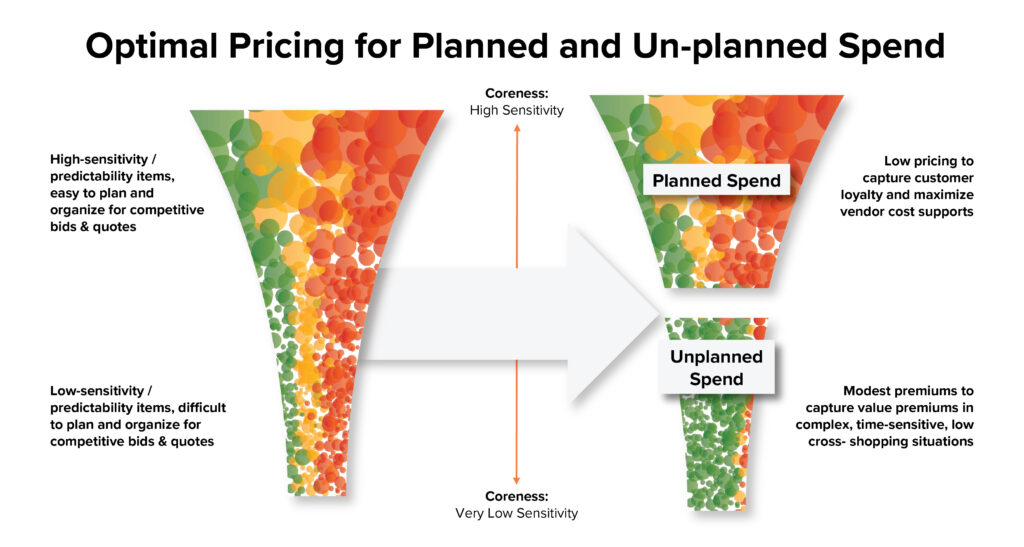

Industrial B2B buyers usually face significant purchasing complexity. These buyers are purchasing hundreds or thousands of products in varying quantities, with varying frequency and repeatability, across varying suppliers and product families. As a result, they face daunting complexity in optimizing their own equation of value versus price. This complexity creates a natural division between planned spend (which can be forecasted and organized with some confidence, and thus cross-shopped) and unplanned spend (which is more unpredictable, variable, and complex).

Depicting the buyer’s (and seller’s) challenge above, the left image shows the total spend history for a given period across both planned and unplanned spend. We develop a metric, Coreness, which assesses how difficult and valuable it is for the buyer to identify and cross-shop purchases. Every product has a Coreness rating. Purchases at the top of the basket are highly susceptible to planning and cross-shopping. Those at the bottom of the basket are difficult to plan and ineffective and complex to cross-shop. The shape and ratio of the planned vs. unplanned segments on the right will vary from customer to customer and over time.

Because different suppliers will reply to quote requests in different formats and communication modalities, with varying products and available quantities, the complexity of the Bids & Quotes process is daunting. In addition, after sifting through emails, spreadsheets, and PDFs — and trying to organize competing bids for comparability — buyers try to identify the best value versus price across their varying bidders.

Contrary to sales lore, most buyers loathe the Bids & Quotes process and seek to implement it only on the planned spend of their market basket. Doing so with unplanned spend is essentially purgatory.

A Dual Pricing Strategy

In markets where buyer-complexity traits support a dual-strategy approach to pricing, the sales team’s revenue job is to win new business and share of wallet on planned spend with aggressive (but value-based) pricing. The sales team’s margin job is to consistently and effectively capture value-based premiums on unplanned spend.

How can sellers accomplish this? They need pricing teams to profile the buyer spend characteristics and provide the associated pricing structures and tools (such as contract-management software) to dynamically divide the market basket between planned and unplanned spend. They need value-based, win-driven price points for the top, and margin-driven premiums for the bottom.

Customer Acquisition and Life-Cycle Pricing Strategy

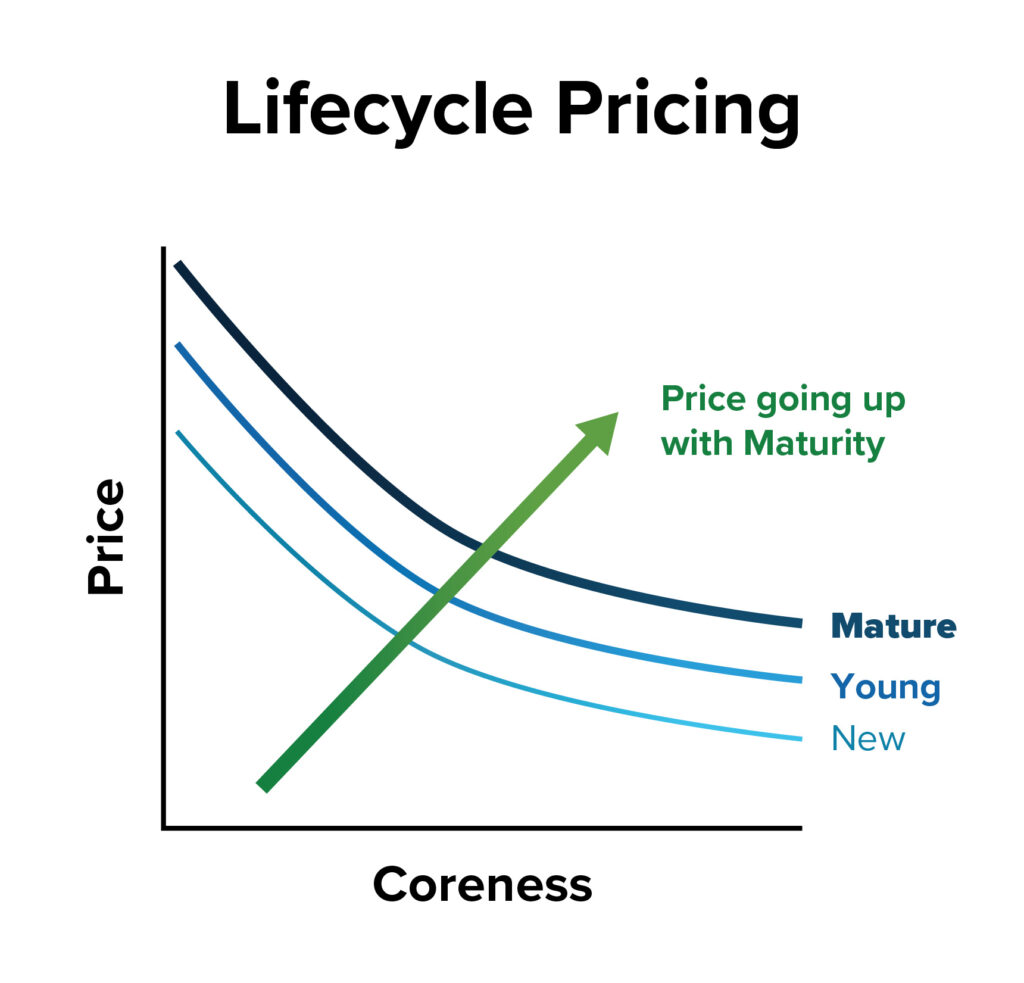

The lifeblood of every business is its ability to continuously generate new business and grow share of wallet in existing business. To optimize sales activities and pricing strategy, it’s useful to introduce the concept of Lifecycle Pricing. For new customers, a supplier’s actual performance is unknown at the outset. In addition, due to switching costs, many customers are further resistant to changing suppliers even when the incumbent’s value deteriorates.

For these reasons, a value-based pricing strategy must adapt to the lifecycle progression of perceived and actual value. Lifecycle pricing deploys a different set of pricing standards for new business versus mature business.

Bonus Round: Vendor Cost Supports

High-performing sales teams in many industries take these lifecycle- and dual-pricing strategies a step further by leveraging vendor cost supports (SPAs, rebates and claimbacks) to shift the cost of new-business acquisition upstream to their vendors. While obvious, in practice sales teams under-leverage their supplier rebates by 30 percent or more, resulting in lower new-business capture, sub-par profitability or both.

Pulling It Off: Specialized Sales Teams

It’s often too much to ask of a single generalist sales team to execute all of these strategies, with themes, tactics and tools that oppose one another, on the surface. As a result, many sales teams are now dividing key roles to ensure simplicity of goals and execution:

- Deal Desk: responsible for capturing low-margin projects and line-reviews on planned spend; working with vendors to get needed cost supports

- Business Development: responsible for new-customer prospecting and acquisition, leveraging lifecycle and dual pricing and vendors

- Account Management: responsible for mature customer pricing, managing the evolving lifecycle and dual pricing structures to drive share of wallet and net profitability while sustaining and growing vendor cost supports

Pricing’s job is to support each of these specialists with the tools they need to master the strategy. Sales’ job is to consistently execute the simplified mission of each role according to its part in the strategy.

Conflict Resolved?

While some level of tension between revenue maximization and profit maximization is perhaps unavoidable, market-leading companies are leveraging new strategic models and role-specialization to unlock new opportunities to both grow revenue and grow profits. Respecting the distinct roles of sales specialists and pricing teams, their remaining conflicts are typically edge cases where strategy is more subjective.

Most importantly, their disagreements are now based on a common set of principles and a proper balancing of strategic levers to achieve a single goal: maximized long-term profitability. When it comes sales and pricing, if they knew better, they’d do better.

About the Author

As CEO of SPARXiQ, David Bauders has been committed to helping companies accelerate sales and profitability with the right analytics, tools and complementary skills training since he founded the company in 1993.

The post What Sales and Pricing Teams Need From Each Other appeared first on National Association of Wholesaler-Distributors.